estatechoice.site

New Homes

Zillow Sylvan Beach Ny

To support our service, we display Private Sponsored Links that are relevant to your search queries. These tracker-free affiliate links are not based on your personal information or browsing history, and they help us cover our costs without compromising your privacy. If you want to enjoy Ghostery without seeing sponsored results, you can easily disable them in the search settings, or consider becoming a Contributor. Zillow has 8 homes for sale in Sylvan Beach NY. View listing photos, review sales history, and use our detailed real estate filters to find the perfect place. . Zillow has 2 homes for sale in View listing photos, review sales history, and use our detailed real estate filters to find the perfect place. . The leading real estate marketplace. Search millions of for-sale and rental listings, compare Zestimate® home values and connect with local professionals. . Book amazing rentals on Vrbo - the most popular vacation rental site in the US. ✓+2 million rentals worldwide ✓19+ million reviews ✓Secure online payment ✓24/7 Customer Service . Zillow has 1 homes for sale in Verona Beach NY. View listing photos, review sales history, and use our detailed real estate filters to find the perfect place. . View 16 homes for sale in Sylvan Beach, NY at a median listing home price of $, See pricing and listing details of Sylvan Beach real estate for sale. . If you enjoy Ghostery ad-free, consider joining our Contributor program and help us advocate for privacy as a basic human right.

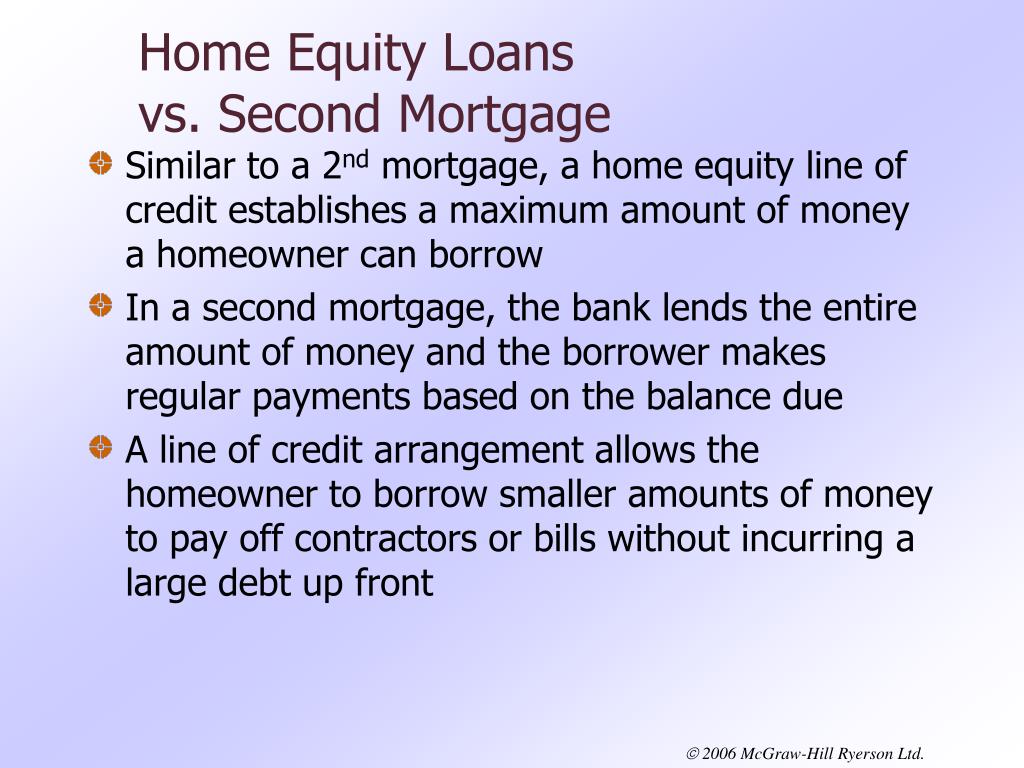

Is An Equity Loan A Second Mortgage

To support our service, we display Private Sponsored Links that are relevant to your search queries. These tracker-free affiliate links are not based on your personal information or browsing history, and they help us cover our costs without compromising your privacy. If you want to enjoy Ghostery without seeing sponsored results, you can easily disable them in the search settings, or consider becoming a Contributor. A second loan, or mortgage, against your house will either be a home equity loan, which is a lump-sum loan with a fixed term and rate, or a HELOC, which features variable rates and continuing access to funds. . Borrowing against your home equity can help you access ready cash. Learn if a second mortgage vs. home equity loan could be a good idea. . Homeowners with enough equity in Get matched with a lender that can help you reach your financial goals · Home equity loans are a type of second mortgage if there is already a lien on the home. . A home equity loan is a type of second mortgage, so there is no difference. However, a · If you need cash for making home improvements, paying college tuition, paying-off high-interest credit card debt, paying medical bills, or financing a new small business, then a second mortgage could help . The first thing to understand about home equity is the different ways you can use your home to deliver a cash injection – the two primary ones are a home equity line of credit (HELOC) and a home equity loan, which is often called a second mortgage. . A second mortgage or junior-lien is a loan you take out using your house as collateral while you still have another loan secured by your house. Home equity loans and home equity lines of credit (HELOCs) are common examples of second mortgages. . Second mortgage interest rates differ depending on factors like the second mortgage type, your financial health, and the lender you choose to borrow from. A home equity loan is a type of second mortgage that lets you borrow against your home equity. . A second mortgage is a home-secured loan taken out while the original, or first, mortgage is still being repaid. Like the first mortgage, the second mortgage uses your property as collateral. A home equity loan and a home equity line of credit (HELOC) are two common types of secondary mortgages. . Your home might be your castle main ways to tap into the equity built up in your home: a home equity line of credit (HELOC) and a second mortgage (home equity loan). . Want a pool or updated kitchen? Use your home’s equity. Learn how a second mortgage, HELOC and home equity loans could work for you. . If you enjoy Ghostery ad-free, consider joining our Contributor program and help us advocate for privacy as a basic human right.

Escrow Canada

To support our service, we display Private Sponsored Links that are relevant to your search queries. These tracker-free affiliate links are not based on your personal information or browsing history, and they help us cover our costs without compromising your privacy. If you want to enjoy Ghostery without seeing sponsored results, you can easily disable them in the search settings, or consider becoming a Contributor. An experienced trust officer assigned to your escrow account · Investment services where applicable—such as investing cash or providing competitive interest rates on balances 1 Please note our legal entity, Royal Trust Corporation of Canada or The Royal Trust Company (in Quebec), can . than in Canada. By definition, the word refers to funds that are held in trust for a third party. For example, many Canadian lenders use escrow accounts to collect and store property taxes on behalf of their mortgage clients. These accounts are commonly referred to as property tax accounts. . When buying classic cars, a used sailboat or even an aircraft engine estatechoice.site ensures money transfer and vehicle delivery with every sale. Our experienced personnel can even help you with shipping documentation, titles, liens and more. . Practical Law Canada Glossary (Approx. 2 pages) A legal arrangement in which an asset (such as cash or securities) is deposited into an account under the trust of a third party (the escrow agent) until satisfaction of a contractual contingency or condition. . Real estate differs from country to country, and comparing Canada to the [ ] . When it comes to mortgage financing, the term “escrow” is more commonly used in the United States than in Canada. However, escrow accounts do exist in Canada, particularly in relation to property taxes. . Let’s talk about escrow! While this arrangement may not necessarily impact your mortgage, it can be helpful to understand should anything come up throughout your term. What is Escrow Starting with the basics, what IS escrow exactly? Escrow refers to a financial agreement where assets or finances . This entity handles all documents $2, to $5, for a $, home. In real estate transactions across Canada, escrow ensures a secure and smooth transfer of funds and property. . Ask a lawyer, and get customized answers to all your Canadian legal questions online - ASAP, from a lawyer with verified professional credentials. . On the other hand, escrow protects the seller by assuring them that the buyer is committed to the transaction and by ensuring that the seller receives full payment only when all conditions are fulfilled. In Canada, escrow refers to a similar financial arrangement as in other countries. . If you enjoy Ghostery ad-free, consider joining our Contributor program and help us advocate for privacy as a basic human right.